The Digital Banking Market business report initiates with an exploration of fundamental industry aspects, encompassing market definitions, classifications, applications, and an overview of the industry chain. Subsequently, it delves into comprehensive coverage of industry policies, plans, product specifications, manufacturing processes, cost structures, and more. This compelling Digital Banking Market survey report stands out as a valuable resource, presenting both current and anticipated technical and financial insights within the industry.

Several notable features employed in the creation of this market research report include a high level of diligence, practical solutions, dedicated research and analysis, innovation, integrated approaches, and the integration of the latest technology. For businesses, gaining insights into consumer demands, preferences, attitudes, and evolving tastes regarding specific products is essential, and this report serves as a comprehensive guide for such understanding.

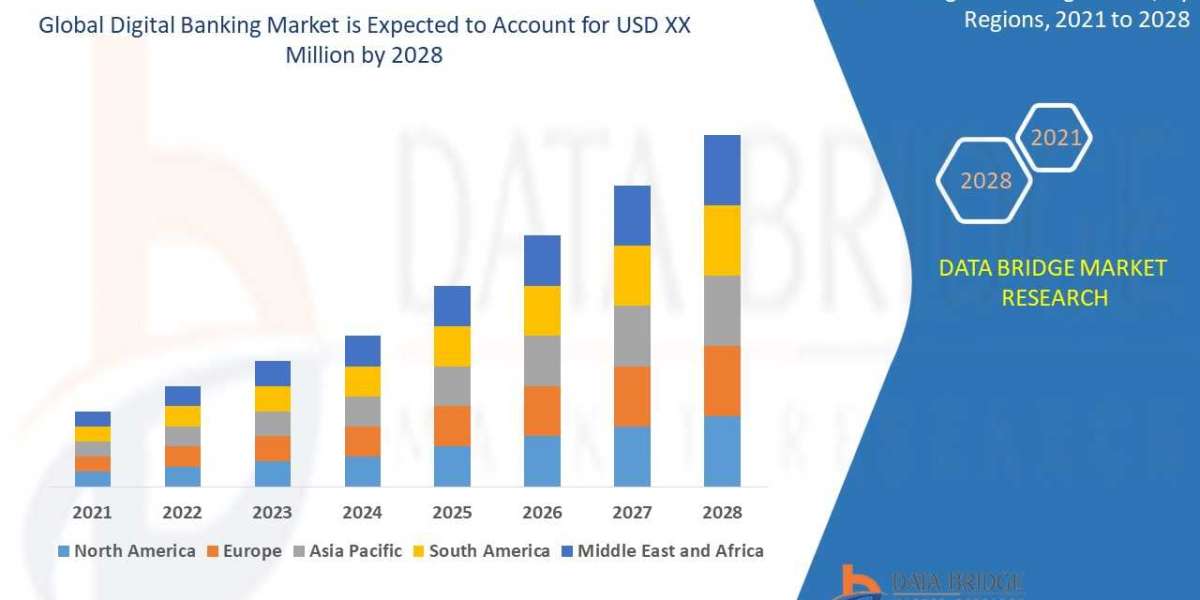

The digital banking market is expected to witness market growth at a rate of 7.45% in the forecast period of 2021 to 2028. Data Bridge Market Research report on digital banking market provides analysis and insights regarding the various factors expected to be prevalent throughout the forecast period while providing their impacts on the market’s growth. The rapid digitization globally is escalating the growth of digital banking market.

See Comprehensive Report @ https://www.databridgemarketresearch.com/reports/global-digital-banking-market

Market Definition:

The digital banking market is expected to witness market growth at a rate of 7.45% in the forecast period of 2021 to 2028. Data Bridge Market Research report on digital banking market provides analysis and insights regarding the various factors expected to be prevalent throughout the forecast period while providing their impacts on the market’s growth. The rapid digitization globally is escalating the growth of digital banking market.

Key players:

- S.

- Canada and Mexico in North America

- Brazil

- Argentina and Rest of South America as part of South America

- Germany

- Italy

- K.

- France

- Spain

- Netherlands

- Belgium

- Switzerland

- Turkey

- Russia

- Rest of Europe in Europe

- Japan

- China

- India

- South Korea

- Australia

- Singapore

- Malaysia

- Thailand

- Indonesia

- Philippines

Scope / Segmentation:

The digital banking market is segmented on the basis of services, deployment type, technology and industries. The growth among segments helps you analyze niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

- On the basis of services, the digital banking market is segmented into non-transactional activities, and transactional. Transactional services are further segmented into cash deposits and withdrawals, fund transfers, auto-debit/auto-credit services and loans. Non-transactional activities are further segmented into information security, risk management, financial planning and stock advisory.

- On the basis of deployment type, the digital banking market is segmented into on-premises and on cloud.

- On the basis of technology, the digital banking market is segmented into internet banking, digital payments and mobile banking.

- On the basis of industries, the digital banking market is segmented into media entertainment, manufacturing, retail, banking, and healthcare.

Investing in this study provides access to valuable insights, encompassing:

- Comprehensive Industry Coverage: Gain a thorough understanding of the industry on a global scale, with detailed breakdowns by region.

- Regional Market Analysis: Explore regional-level insights covering North America, Europe, Asia Pacific, South America, and the Middle East Africa.

- Country-Specific Market Data: Access market size breakdowns for key countries, highlighting major market shares.

- Leading Players' Performance: Obtain market share and revenue/sales data for the industry's foremost players.

- Market Trends Analysis: Stay informed about emerging technologies, products, and start-ups, along with comprehensive analyses such as PESTEL Analysis, SWOT Analysis, and Porter's Five Forces.

- Detailed Market Size Information: Delve into detailed market size data, including breakdowns by application/industry verticals.

- Projections and Growth Forecasts: Receive insights into future growth and development forecasts for the market.

This Market Intelligence Report addresses critical concerns:

- Segment Development: Understand how major segments in the international market are expected to evolve in the coming years.

- Dominant Players: Identify the major players set to dominate the market in the future.

- Suppliers and Producers: Gain insights into the top suppliers and producers in the industry.

- Strategic Planning of Successful Companies: Analyze how successful companies in the industry are planning for future growth and expansion.

- Anticipated Demand Increase: Identify sectors where the greatest increase in demand is expected in the upcoming years.

- Market Demographics: Understand the distinct subsets of buyers shaping this market.

- Regional Powerhouses: Predict the regional powerhouse that is poised to become the largest player in the international market.

- Impact of New Coronavirus Pandemic: Assess the potential consequences of a new coronavirus pandemic on the industry.

- Challenges for Established Actors: Examine how established actors may face challenges from newcomers and strategies to overcome them.

Table of Contents:

- Introduction

- Segmentation of the Market

- Executive Summary

- Key Insights

- Regulatory Landscape for DIGITAL BANKING MARKET

- Overview of the Market

- DIGITAL BANKING MARKET by Type

- DIGITAL BANKING MARKET by Material

- DIGITAL BANKING MARKET by Application

- Continued...

Additional Reports / Browse More Reports:

- Global Data Center Busway Market – Industry Trends and Forecast to 2028

- Global Factory Automation Market – Industry Trends and Forecast to 2029

- Global Enterprise Resource Planning Technologies Market – Industry Trends and Forecast to 2030

Data Bridge Market Research:

Today's trends are a great way to predict future events!

Data Bridge Market Research is a market research and consulting company that stands out for its innovative and distinctive approach, as well as its unmatched resilience and integrated methods. We are dedicated to identifying the best market opportunities, and providing insightful information that will help your business thrive in the marketplace. Data Bridge offers tailored solutions to complex business challenges. This facilitates a smooth decision-making process. Data Bridge was founded in Pune in 2015. It is the product of deep wisdom and experience.

Contact us: -

Data Bridge Market Research

US: +1 888 387 2818

UK: +44 208 089 1725

Hong Kong: (852) 8192 7475

Email:- [email protected]