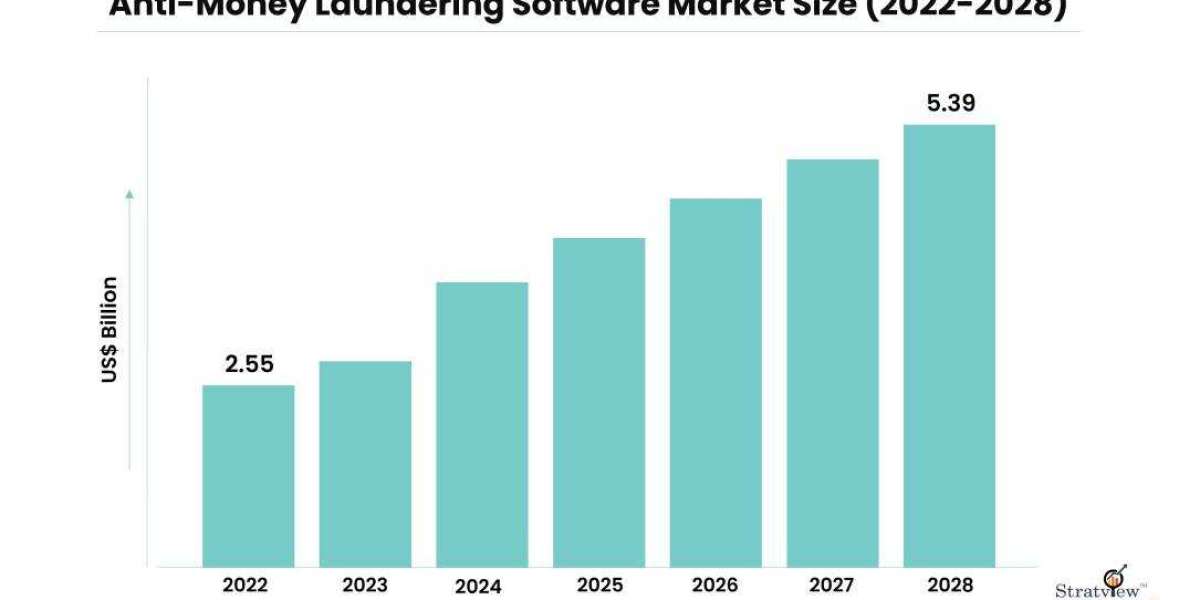

Money laundering poses a significant threat to the global financial system, allowing criminals to hide the origins of illicit funds and fund illegal activities. To combat this menace, governments and financial institutions around the world are increasingly relying on anti-money laundering (AML) software solutions. The global AML software market has witnessed significant growth in recent years, driven by regulatory requirements, rising financial crime, and advancements in technology. However, this growth is accompanied by several challenges and opportunities that shape the dynamics of the market. The anti-money laundering software market is estimated to grow from USD 2.55 billion in 2022 to USD 5.39 billion by 2028 at a CAGR of 13.20% during the forecast period.

One of the key challenges in the AML software market is the ever-evolving nature of money laundering techniques. Criminals constantly adapt their strategies to exploit vulnerabilities in existing systems, making it essential for AML software providers to stay ahead of the curve. AML software solutions must incorporate robust risk assessment algorithms, machine learning capabilities, and real-time monitoring to effectively detect suspicious activities. Keeping up with the changing regulatory landscape is another challenge. Governments worldwide are implementing stricter AML regulations, necessitating frequent updates to compliance frameworks. AML software providers must ensure their solutions comply with these regulations and offer seamless integration with existing systems.

The sheer volume of data is another challenge faced by the AML software market. Financial institutions generate vast amounts of data daily, making it difficult to analyze and identify suspicious patterns manually. AML software solutions must leverage big data analytics, artificial intelligence, and natural language processing to process and analyze this data efficiently. Implementing robust data governance practices and ensuring data security are also crucial aspects that need to be addressed to gain the trust of financial institutions and regulators.

Furthermore, the global nature of money laundering presents challenges related to international cooperation and data sharing. Money laundering activities often involve multiple jurisdictions, requiring cross-border collaboration between financial institutions and regulatory bodies. AML software providers should develop solutions that facilitate information sharing while ensuring data privacy and compliance with international data protection regulations. Establishing secure networks and standardized protocols for data exchange can enhance the effectiveness of AML efforts globally.

While challenges abound, the AML software market also presents significant opportunities for innovation and growth. Technological advancements, such as the adoption of artificial intelligence and machine learning, offer immense potential for improving AML capabilities. These technologies can enhance the accuracy of transaction monitoring, automate risk assessment processes, and enable proactive detection of suspicious activities. AML software providers that harness the power of these technologies will have a competitive edge in the market.

Another opportunity lies in the integration of AML software with other financial crime prevention solutions. Combining AML software with fraud detection, know-your-customer (KYC) verification, and cybersecurity solutions can create a comprehensive and synergistic approach to combat financial crime. Integrated platforms can streamline processes, reduce operational costs, and provide holistic insights into potential risks.

Additionally, the increasing adoption of cloud computing and software-as-a-service (SaaS) models offers scalability and cost-effectiveness for AML software solutions. Cloud-based AML software can handle large data volumes, provide real-time updates, and offer flexible deployment options. This enables financial institutions of all sizes to access sophisticated AML capabilities without significant infrastructure investments.

In conclusion, the global AML software market is facing a multitude of challenges, ranging from evolving money laundering techniques to data management and international cooperation. However, these challenges also present opportunities for innovation and growth. AML software providers must invest in advanced technologies, prioritize compliance with regulations, and develop integrated solutions to stay competitive. As governments and financial institutions intensify their efforts to combat money laundering, the AML software market will continue to evolve, offering immense potential to safeguard the integrity of the global financial system.